What About Housing Prices During Hyperinflation?

A very large possibility for the future of The US Dollar is hyperinflation. (well, at least galloping inflation)

Real estate is considered a physical asset, and as such, will be a good place for investments through a hyperinflation. But, are they?

Most people believe that they just have to make it through the hyperinflation, and then the house will not have lost value, it's still a house, and after a stable currency works itself out, that they will be sitting pretty.

Yes, if you survive the hyperinflation with your house intact, then yes, at the other end, you will have a house, that you may have paid off with really cheap money.

But there is a huge problem here. The house, and its maintenance, and its value are not static, especially in comparison to other things.

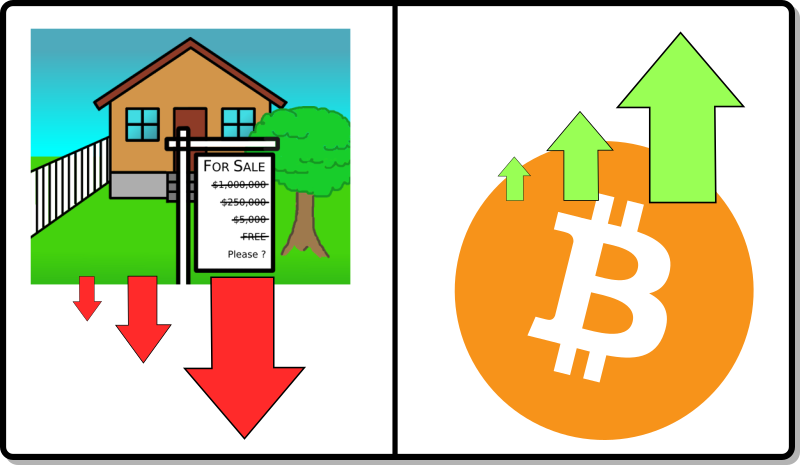

Everything is going to zero, compared to bitcoin. - Max Keiser

Value of a house during hyperinflation

Unfortunately the price of a house isn't based on any real fundamentals. It is based almost solely upon how much money a person can borrow from the bank to "buy" the house.

2008 showed us that ever higher house prices are not a reality.

There is a limit to how much all the people can borrow. And how much they can borrow is based on their credit worthiness and income. So, unless we see a huge spike in people's income, we know pretty much the absolute house price is.

Now that the interest rates more than doubled, house prices need to come down by half (they do not need to come down that much to maintain equal house payments, but it needs to fall further to restart buying) if we want to see an actual housing market.

But, what happens during hyperinflation?

The amount people can pay goes up slowly, while the price goes up quickly.

People losing faith in the hyperinflating currency want a lot more for their items (including real estate) then they did before. It isn't worth it to sell your property for something that is literally going poof while you hold it in your hands.

Opposite of this, people with excess real estate may try to sell it for whatever they can get. They want to sell for reasons such as, needing to pay off stock market losses. They want to get into other asset classes like gold. They want to get out of the country.

And the Lord save rentals, because you can't raise rents fast enough to keep up with ever increasing maintenance costs. Even if you could adjust the rents each month, no one could afford much higher prices. Their salaries are not keeping up either.

So, basically, real estate may be skyrocketing in dollar terms, but there will be no one to buy at those really high prices.

Is Real Estate An Asset?

Your house is not an asset - Robert Kiyosaki

Houses are only considered an asset because their prices keep going up.

However, houses during a hyperinflation will be going down in value, if we could measure them in a stable currency. Further, there are other things happening that will make houses worth less.

It is easiest to see this in commercial real estate right now. Businesses are going bankrupt. Businesses are downsizing. People are working from home. The need/desire for commercial real estate is massively dropping.

So, during a hyperinflation, these building will almost become worthless. While their prices still go up.

The same with housing. During trying times, like hyperinflation, we lose a lot of people. A lot less people means a lot less demand for houses. And if the area sees a big loss of jobs, then there will be negative demand for houses. As in, we will have so many vacant houses that they really aren't worth anything.

Bitcoin hyperinflates too?

If we see hyperinflation in The US Dollar, we will see the price of bitcoin soar. We will see the price of gold soar. We will see the price of houses, in bitcoin, drop and drop and drop.

People will be looking for "gold" during these times. An asset that at least maintains its value while the currency goes to zero.

Gold, silver, lead, food… and crypto currencies are the things people will be trying to get. The insanity to get out of the crashing currency and into one of these assets will be real.

So, the value of the currency goes down, while the value of these assets goes up. Meaning, if you wanted a house, you will be able to drop dust and acquire it. Tons of people will be selling that property that they always dreamed they could build a house on… someday. Anything that can be sold, will be sold, just for people to stay fed.

Houses per bitcoin will rise to unbelievable numbers. I mean it, houses may be traded for satoshis.

The reason i bring up hyperinflation is that the Fed said they wanted to stop inflation, but really they just wanted to bring it "under control". Their greatest fear is deflation. If their asset prices deflate, they are screwed. All the banks are bankrupt. So, the Fed will inflate. Unfortunately, the banks have already lost. Asset prices like commercial real estate, stocks, and bonds are already dropping. And the boomers retiring will make it even worse.

So, we will see deflation in these kinds of assets while food and gasoline inflate through the roof.

We will see people in California panning for gold to buy groceries.

And for the crypto holders, we will see all kinds of sales on every kind of toy imaginable.

Hyperinflation is a scary event. Same with a currency collapse. We are going to see huge changes in our lives as the banks collapse and banksters are hung from lamp posts. I would hope that everyone moves to cryptos soon and quickly, but we all know that many people are going to hang on to their dollars as the disintegrate in their hands.

The best asset will be a homestead where you grow your own food.

Congratulations @builderofcastles! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

I agree. A homestead that is outside of the blast radius if we are eating nukes for dinner one of these days.

One of the things that I have seen is that the RV market is collapsing and in a tough scenario someone can bunker down in an RV on a homestead that like you said was a property someone wanted to build their dream home but didn't get to it.

If the grid goes down with the right solar setup and with Starlink someone could have a decent setup and thug it out.

I think there is comfort in knowing that I can survive with very little resources if it comes down to it.

That being said if we don't get blasted in the next couple of years I'm looking to really harness AI and become hyper efficient to completely secure my future.