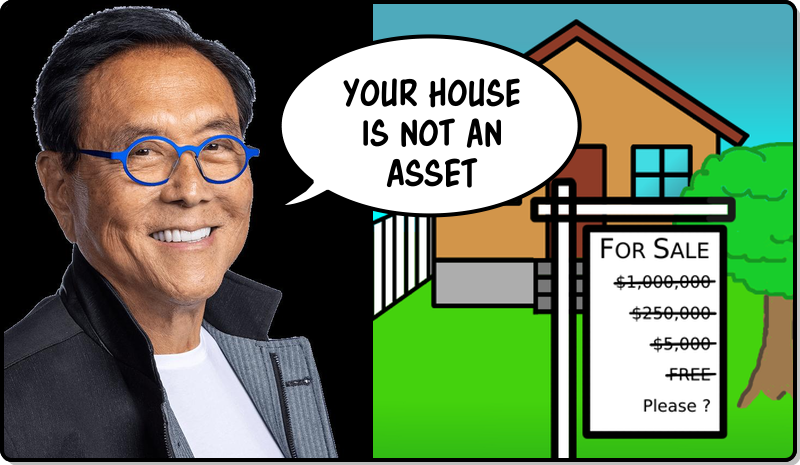

Your House Is Not An Asset. And Soon, It Will Be Worth Nothing.

Many people think they are rich because the house they are living in is valued at a really high number.

But you really cannot get access to that money. You need a place to live, and all you can really do is trade one over-priced house for another over-priced house. Or you can sell your house to the bank, and play games with refinancing for a while.

Further, when you own a house, you have to pay to maintain it. Thus, it is truly a liability, not an asset.

Your house is not putting money in your pocket (definition of an asset) it is taking money out. (definition of a liability)

Housing used to be a good investment

Well, it was more that houses were a good value, and banks kept making it cheaper to get a mortgage. Today, houses are WAY overvalued. And because of the hike in interest rates, they are WAY, WAY overvalued. Normal people can't afford housing.

The problem with this scenario is that a lot of people have to take a loss before it corrects. Imagine the terror of the house owner, thinking they have a million dollars, but realizing they only have half of that. This is why the correction takes so long.

Average priced houses aren't selling. Higher priced houses are now being seen dropping 10k, even 100k off the price, and they are not getting offers at the new price. We will see more price reductions.

And, if this was a normal market cycle, we would see house prices continue to drop until the houses are undervalued, and then the cycle would start again.

But, this cycle is different. We aren't going to play this game no more. The underlying structure of what a house is, is changing.

Suburban Housing Goes DOWN, Down, down

All the forces are ganging up on suburban home prices.

- Demographics

- All Causes Mortality

- Natural Disasters

- No more mortgages (bank closures)

- Working from home

- Turning commercial real estate into apartments

- Migrants fleeing

- Crime

Just think, the boomers, owners of 25% of the houses are moving out. To retirement homes or mortuary plots. That is 25% of the housing going to be dumped on the market.

What would a spike, in inventory, that large do to the housing market? Just that would cause house prices to become unknown. See in your mind, a street with every fourth house with a for sale sign.

And this is only one of the catastrophes that will affect suburban house prices. One of many.

In the near future, we will see entire housing tracts abandoned.

Real Estate Turned Upside Down and Inside Out

We have a weird thing about divvying up all the land and not leaving any for the future generations. This will come to a stop. People will work out that this was a very bad thing to do to the children.

Further, the structures that caused people to clump together in large cities are going away. We don't need to be in a large factory to build things. We won't be tied to the electric grid for our power. The roads and the water ways will not be necessary for travel/exchange.

Everything that defined a city, and caused it to grow, will be gone.

And all that will be left in most large cities is starvation, crime and death.

In the future, a group of people will find a nice place to live and start a small community/town/family there. And there is lots of place where you could go, that there are no other humans around for miles. No one will be competing for property.

Things are massively changing. And most people watching the housing market think that this is just another downturn.

If i can give any advice, it is to stop thinking of your home as an asset. It would be better to think of it as being valueless (as something you cannot sell), and the only value is how much food it can give you.

To try to make money from your house may already be a fools errand. In the past, people would sell at the top and rent till the housing market crashed, then buy up more. This time, i do not think you will have a way of keeping that money through the crash. And in many places, the rent is more than a mortgage.

The only arbitrage i can recommend is selling your suburban house and buying a homestead away from the cities.

The suburban homes value/price is toast. I mean, it will go from $1,000,000 to $100,000 and then to $1,000 as all the things that supported the higher price are gone (like banks giving mortgages, people having money/jobs, there being a shortage of houses). It will all be gone.

Sounds like you read "Rich Dad, Poor Dad" and enjoyed it just as much as I did haha. Kiyosaki did always say that a house is actually a liability, NOT an asset. And remember to stay out of those employee / self-employed quadrants!

Personally I am hesitant to invest in real estate given the precarious global financial situation we find ourselves in. When government is working well your property rights are respected, but what about in a (economic) disaster situation? They may need to confiscate your house "for the greater good", and who knows, redistribute it as they see fit. Have you looked into "the great taking"?

There is one asset, however, that cannot be confiscated from you ;) and would likely increase in value in the event of economic turmoil. Ultimately, it might be better to buy physical property after the dust settles.