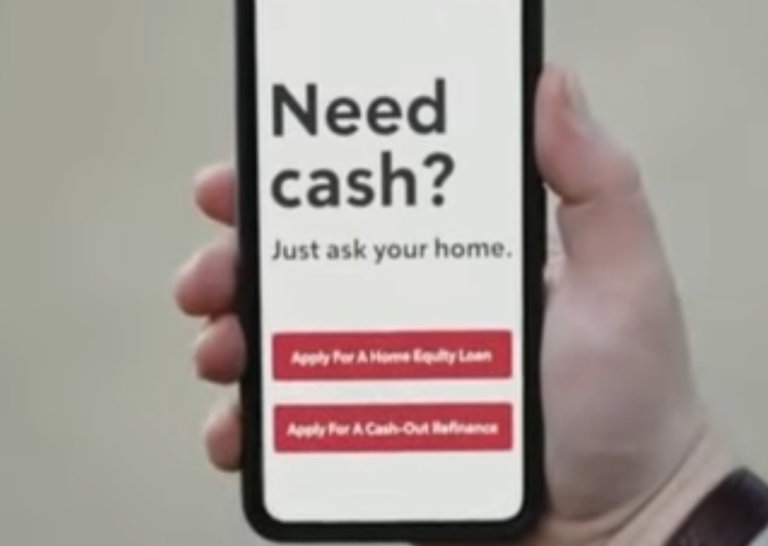

Just Ask Your Home?

Echoes of the Past: Home Equity and the Financial Crisis

The financial crisis of the late 2000s was, in part, fueled by reckless lending practices, with homeowners leveraging their home equity without sufficient risk management. The consequences were dire, leaving a lasting impact on the economy. The recent commercial brings back memories of those turbulent times, raising questions about the responsibility associated with tapping into home equity.

Changing Times: Inflation and Economic Pressures

As inflation exerts its pressures on households, the idea of using home equity for financial needs becomes both tempting and concerning. While lending criteria have seen improvements, the economic challenges faced by many individuals warrant a cautious approach. The juxtaposition of economic pressures and the lure of accessible equity underscores the delicate balance required in financial decision-making.

The Housing Market Conundrum: Strong Yet Complex

The current housing market, characterized by robust prices and substantial homeowner equity, stands in contrast to the complexities of the broader economy. Low-interest rates contribute to the resilience of the housing market, but the potential consequences of widespread equity extraction cannot be ignored. Some could have tapped into equity for speculative reasons which could create downward spiral in economic activity.

Responsibility in Marketing: Navigating Economic Waters

The commercial raises questions about the responsibility of marketing messages in times of economic flux. While the housing market may remain strong, promoting the use of home equity demands a nuanced approach. Homeowners navigating these financial waters should consider the potential long-term implications of leveraging their home equity in a changing economic landscape.

In conclusion, as the economic tide continues to shift, responsible financial decisions become paramount. The echoes of the past serve as a reminder that the responsible use of home equity is not only an individual choice but a collective consideration for the stability of the broader economic seas.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.